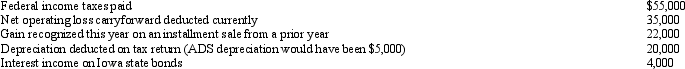

Scarlet Corporation (a calendar year taxpayer) has taxable income of $150,000,and its financial records reflect the following for the year.  Scarlet Corporation's current E & P is:

Scarlet Corporation's current E & P is:

A) $127,000.

B) $107,000.

C) $97,000.

D) $57,000.

E) None of the above.

Correct Answer:

Verified

Q8: For a stock redemption to qualify for

Q26: Dividends taxed as ordinary income are considered

Q28: If stock rights are taxable, the recipient

Q30: Constructive dividends do not need to satisfy

Q36: A corporate shareholder that receives a constructive

Q39: Under certain circumstances, a distribution can generate

Q43: Platinum Corporation,a calendar year taxpayer,has taxable income

Q46: Sally and her mother are the sole

Q49: Grackle Corporation (E & P of $600,000)

Q53: A shareholder's holding period of property acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents