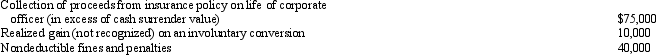

Platinum Corporation,a calendar year taxpayer,has taxable income of $500,000.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes,Platinum Corporation's current E & P is:

Disregarding any provision for Federal income taxes,Platinum Corporation's current E & P is:

A) $455,000.

B) $535,000.

C) $545,000.

D) $625,000.

E) None of the above.

Correct Answer:

Verified

Q8: For a stock redemption to qualify for

Q14: In a redemption to pay death taxes,

Q28: If stock rights are taxable, the recipient

Q30: Constructive dividends do not need to satisfy

Q39: Under certain circumstances, a distribution can generate

Q41: Scarlet Corporation (a calendar year taxpayer)has taxable

Q46: Sally and her mother are the sole

Q49: Grackle Corporation (E & P of $600,000)

Q53: A shareholder's holding period of property acquired

Q57: As a result of a redemption, a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents