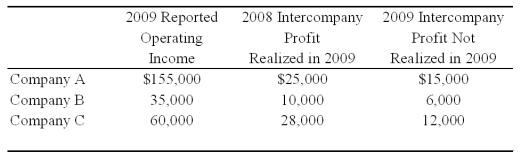

Company A owns 85 percent of Company B's stock and 80 percent of Company C's stock.All acquisitions were made at book value.The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies.The companies file a consolidated tax return each year and in 2009 paid a total tax of $112,000.Each company is involved in a number of intercompany inventory transfers each period.Information on the companies' activities for 2009 is as follows:

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

-Based on the information provided,income to the controlling interest for 2009 is:

A) $155,370.

B) $56,000.

C) $168,000.

D) $250,000.

Correct Answer:

Verified

Q19: Assume that New Life uses the direct

Q31: Catalyst Corporation acquired 90 percent of Trigger

Q32: Using the data presented in question 38:

1)Prepare

Q33: Catalyst Corporation acquired 90 percent of Trigger

Q34: Company A holds 70 percent of the

Q37: Flyer Corporation holds 90 percent of Kite

Q38: Company A owns 85 percent of Company

Q40: Catalyst Corporation acquired 90 percent of Trigger

Q41: Power Corporation owns 75 percent of Transmitter

Q46: Company A owns 85 percent of Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents