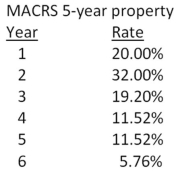

You own some equipment that you purchased 4 years ago at a cost of $225,000.The equipment is 5-year property for MACRS.You are considering selling the equipment today for $87,000.Which one of the following statements is correct if your tax rate is 35 percent?

A) The tax due on the sale is $26,425.

B) The book value today is $186,120.

C) The accumulated depreciation to date is $38,880.

D) The taxable amount on the sale is $38,880.

E) The aftertax salvage value is $70,158.

Correct Answer:

Verified

Q61: Champion Bakers uses specialized ovens to bake

Q62: Colors and More is considering replacing the

Q67: A project will produce an operating cash

Q69: A proposed expansion project is expected to

Q71: Precision Tool is analyzing two machines to

Q72: The Lumber Yard is considering adding a

Q72: You just purchased some equipment that is

Q73: Peterborough Trucking just purchased some fixed assets

Q75: Crafter's Supply purchased some fixed assets 2

Q77: You are working on a bid to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents