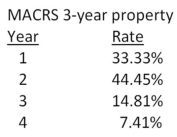

Peterborough Trucking just purchased some fixed assets that are classified as 3-year property for MACRS.The assets cost $10,600.What is the amount of the depreciation expense in year 3?

A) $537.52

B) $1,347.17

C) $1,569.86

D) $1,929.11

E) $2,177.56

Correct Answer:

Verified

Q62: Colors and More is considering replacing the

Q67: A project will produce an operating cash

Q68: Bruno's Lunch Counter is expanding and expects

Q69: A proposed expansion project is expected to

Q71: You own some equipment that you purchased

Q72: You just purchased some equipment that is

Q72: The Lumber Yard is considering adding a

Q75: Crafter's Supply purchased some fixed assets 2

Q77: You are working on a bid to

Q77: Edward's Manufactured Homes purchased some machinery 2

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents