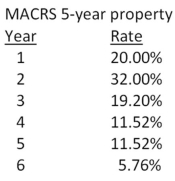

Edward's Manufactured Homes purchased some machinery 2 years ago for $319,000.These assets are classified as 5-year property for MACRS.The company is replacing this machinery today with newer machines that utilize the latest in technology.The old machines are being sold for $140,000 to a foreign firm for use in its production facility in South America.What is the aftertax salvage value from this sale if the tax rate is 35 percent?

A) $135,408

B) $140,000

C) $142,312

D) $144,592

E) $146,820

Correct Answer:

Verified

Q67: A project will produce an operating cash

Q68: Bruno's Lunch Counter is expanding and expects

Q69: A proposed expansion project is expected to

Q72: You just purchased some equipment that is

Q73: Peterborough Trucking just purchased some fixed assets

Q75: Crafter's Supply purchased some fixed assets 2

Q79: Automated Manufacturers uses high-tech equipment to produce

Q80: The Buck Store is considering a project

Q82: Your firm is contemplating the purchase of

Q100: Consider an asset that costs $176,000 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents