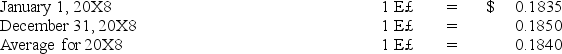

Infinity Corporation acquired 80 percent of the common stock of an Egyptian company on January 1,20X8.The goodwill associated with this acquisition was $18,350.Exchange rates at various dates during 20X8 follow:

Goodwill suffered an impairment of 20 percent during the year.If the functional currency is the U.S.dollar,how much goodwill impairment loss should be reported on Infinity's consolidated statement of income for 20X8?

A) $3,680

B) $3,670

C) $3,690

D) $3,700

Correct Answer:

Verified

Q2: Which of the following statements is true

Q3: If the functional currency is the local

Q4: In cases of operations located in highly

Q5: If the U.S.dollar is the currency in

Q6: All of the following are benefits the

Q7: When the local currency of a foreign

Q8: Under the temporal method,which of the following

Q9: If the restatement method for a foreign

Q10: Infinity Corporation acquired 80 percent of the

Q11: Barcode Corporation acquired 70% of the common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents