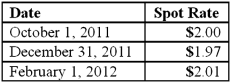

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

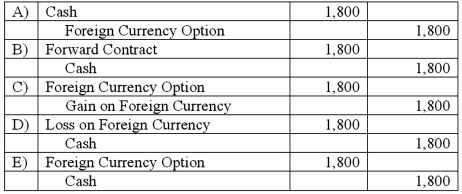

What journal entry should Eagle prepare on October 1, 2011?

A) Option A

B) Option B

C) Option C

D) Option D

E) Option E

Correct Answer:

Verified

Q62: On October 1, 2011, Eagle Company forecasts

Q63: On October 1, 2011, Eagle Company forecasts

Q64: What is the purpose of a hedge

Q68: Old Colonial Corp. (a U.S. company) made

Q71: What happens when a U.S. company purchases

Q72: Yelton Co.just sold inventory for 80,000 euros,

Q74: What happens when a U.S. company sells

Q79: How does a foreign currency forward contract

Q104: How is the fair value of a

Q105: Where can you find exchange rates between

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents