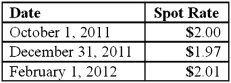

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:

What is the 2012 effect on net income as a result of these transactions?

A) $195,000

B) $201,600

C) $201,000

D) $202,600

E) $203,000

Correct Answer:

Verified

Q44: Lawrence Company, a U.S.company, ordered parts costing

Q58: On March 1, 2011, Mattie Company received

Q60: On March 1, 2011, Mattie Company received

Q62: On October 1, 2011, Eagle Company forecasts

Q66: On October 1, 2011, Eagle Company forecasts

Q68: Old Colonial Corp. (a U.S. company) made

Q71: What happens when a U.S. company purchases

Q72: Yelton Co.just sold inventory for 80,000 euros,

Q79: How does a foreign currency forward contract

Q104: How is the fair value of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents