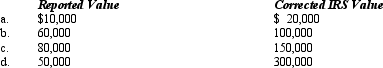

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case,assume a marginal estate tax rate of 45%.

Correct Answer:

Verified

Q90: Yin-Li is the preparer of the Form

Q93: Describe the following written determinations that are

Q96: Isaiah filed his Federal income tax return

Q100: Purple Ltd. ,a calendar year taxpayer,had the

Q105: Kim underpaid her taxes by $30,000.Of this

Q107: Orville,a cash basis,calendar year taxpayer,filed his income

Q111: Why should the tax practitioner study the

Q117: Orange Ltd.withheld from its employees' paychecks $300,000

Q124: Arnold made a charitable contribution of property

Q137: Who are the top two personnel within

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents