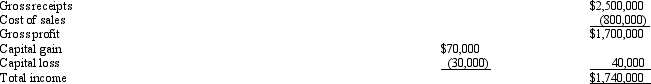

Purple Ltd. ,a calendar year taxpayer,had the following transactions,all of which were properly reported on a timely filed return.Presuming the absence of fraud,how much of an omission from gross income must occur for Purple before the six-year statute of limitations applies? Show your computations.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Compute the undervaluation penalty for each of

Q96: Isaiah filed his Federal income tax return

Q105: Kim underpaid her taxes by $30,000.Of this

Q111: Why should the tax practitioner study the

Q117: Orange Ltd.withheld from its employees' paychecks $300,000

Q123: What taxpayer penalties can arise when a

Q126: Why is it advantageous for both the

Q142: Does the tax preparer enjoy an "attorney-client

Q143: The client has decided to dispute the

Q173: Circular 230 requires that the tax practitioner

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents