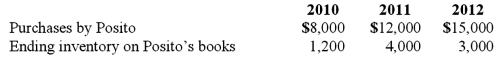

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  Compute the non-controlling interest in Gargiulo's net income for 2010.

Compute the non-controlling interest in Gargiulo's net income for 2010.

A) $6,970.

B) $7,000.

C) $7,030.

D) $6,270.

E) $6,230.

Correct Answer:

Verified

Q49: When comparing the difference between an upstream

Q55: An intra-entity sale took place whereby the

Q55: Gargiulo Company, a 90% owned subsidiary of

Q56: Gargiulo Company, a 90% owned subsidiary of

Q58: Gargiulo Company, a 90% owned subsidiary of

Q61: Stiller Company, an 80% owned subsidiary of

Q62: On January 1, 2010, Smeder Company, an

Q63: Gargiulo Company, a 90% owned subsidiary of

Q64: Wilson owned equipment with an estimated life

Q65: Stiller Company, an 80% owned subsidiary of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents