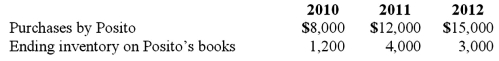

Gargiulo Company, a 90% owned subsidiary of Posito Corporation, sells inventory to Posito at a 25% profit on selling price. The following data are available pertaining to intra-entity purchases. Gargiulo was acquired on January 1, 2010.  Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used. The following data are available pertaining to Gargiulo's income and dividends.  For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2012 consolidation worksheet entry with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2012 consolidation worksheet entry with regard to the unrealized gross profit of the 2011 intra-entity transfer of merchandise?

A) $3,000.

B) $2,400.

C) $1,000.

D) $800.

E) $900.

Correct Answer:

Verified

Q49: When comparing the difference between an upstream

Q53: Patti Company owns 80% of the common

Q58: Gargiulo Company, a 90% owned subsidiary of

Q60: Gargiulo Company, a 90% owned subsidiary of

Q61: Stiller Company, an 80% owned subsidiary of

Q62: On January 1, 2010, Smeder Company, an

Q64: Wilson owned equipment with an estimated life

Q65: Stiller Company, an 80% owned subsidiary of

Q67: On January 1, 2010, Smeder Company, an

Q68: Wilson owned equipment with an estimated life

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents