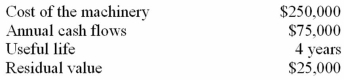

Redman Company is considering an investment in new machinery.The details of the investment are as follows:  The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.

The company uses straight-line depreciation for its machinery and requires a 12% rate of return.The present value of $1 for 4 years at 12% is 0.636.The present value of an ordinary annuity for $1 for 4 years at 12% is 3.037.

(1)What is the payback period? (Round your answer to one decimal place.)

(2)What is the rate of return on average investment? (Round your percentage to one decimal place.)

(3)What is the net present value?

(4)Would you advise the company to invest in this machinery?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Capital budgeting

Flynn Corporation is debating whether to

Q63: Carter & Co.is trying to decide which

Q64: Accounting terminology

Listed below are eight technical accounting

Q67: Capital budgeting computations

A project costing $80,000 has

Q69: Capital budgeting

Mason Co.is evaluating two alternative investment

Q75: The minimum rate of return used by

Q82: The shortcomings of the payback method

What are

Q84: Discounting cash flows

Determine the present value of

Q96: Appraising rate of return adequacy

What factors should

Q97: Capital budgeting

Zhang Corporation is considering investing $190,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents