Capital budgeting

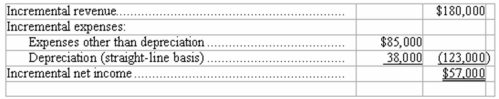

Flynn Corporation is debating whether to purchase a new computerized production system.The system will cost $450,000,and have an estimated 10-year life with a salvage value of $70,000.The estimated operating results from the new production system are as follows:  All revenue and expenses other than depreciation will be received and paid in cash.Compute the following for this proposal: (rounded)

All revenue and expenses other than depreciation will be received and paid in cash.Compute the following for this proposal: (rounded)

(a)Annual net cash flow: $__________

(b)Payback period: __________

(c)Return on average investment: __________

(d)Net present value,discounted at an annual rate of 6% (present value of $1 due in 10 years,discounted at 6%,is 0.558; present value of $1 received annually for 10 years,discounted at 6%,is 7.360): $__________

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Which of the following factors does the

Q63: Carter & Co.is trying to decide which

Q64: Accounting terminology

Listed below are eight technical accounting

Q65: Redman Company is considering an investment in

Q67: Capital budgeting computations

A project costing $80,000 has

Q73: In computing the return on average investment

Q75: The minimum rate of return used by

Q84: Discounting cash flows

Determine the present value of

Q96: Appraising rate of return adequacy

What factors should

Q98: An investment's annual net cash flow will

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents