Consider the following to answer the question(s) below:

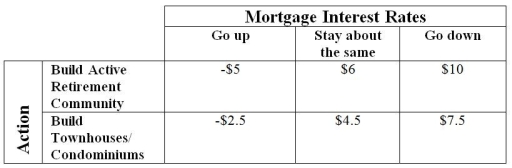

A land owner is considering a community development project. Even though he realizes that the current market for housing is not very favourable, he believes that there will be an influx of retirees into the area within the next five years. He is trying to decide between two alternatives: (1) building detached homes in a planned retirement community or (2) building a smaller townhouse/condominium complex. Mortgage interest rates will affect his outcomes and the applicable payoff (in $ millions) table is shown below.

-Suppose housing analysts predict that the probabilities for future mortgage interest rates going up, staying about the same, and going down are 0.35, 0.50 and 0.15, respectively. The expected value for building an active retirement community is

A) $2.5 million

B) $3.625 million

C) $2.75 million

D) $875,000

E) Indeterminate

Correct Answer:

Verified

Q3: The expected value of perfect information is

A)

Q4: Consider the following to answer the question(s)

Q6: Consider the following to answer the question(s)

Q7: If the land owner is risk averse

Q8: Consider the following to answer the question(s)

Q8: Consider the following to answer the question(s)

Q9: Compute the Coefficient of Variation for each

Q10: Compute the Coefficient of Variation for each

Q11: Consider the following to answer the question(s)

Q14: Consider the following to answer the question(s)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents