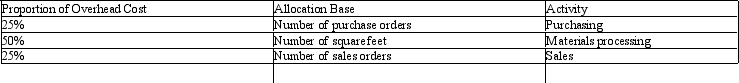

Ken's Carpets sells carpet for both residential and business use. To better estimate costs, the company recently adopted an activity-based costing system. Last year, the company incurred $300,000 in overhead costs. Based on an intense study of their company, the following activities, allocation bases, and percentages of overhead costs were determined:

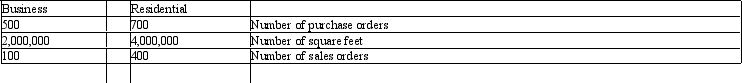

The number of activities for residential and business is as follows:

The number of activities for residential and business is as follows:

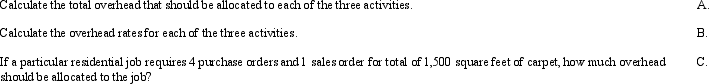

Required:

Required:

Correct Answer:

Verified

Q68: The following overhead cost information is available

Q69: What is meant by the term "activity"

Q70: Can activity-based costing (ABC) be used by

Q71: What are the benefits and limitations of

Q72: Identify and define each of the four

Q73: Discuss how the shift from labor intensive

Q74: Which of the following is a likely

Q75: Classify each of the following costs as

Q76: Thurman Brothers Construction manufactures and installs standard

Q77: Define "cross subsidies" and tell what kind

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents