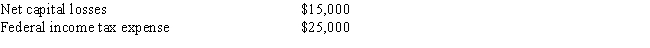

For the current year,the Beech Corporation has net income on its books of $60,000,including the following items: Federal tax depreciation exceeds the depreciation deducted on the books by $5,000.What is the corporation's taxable income?

A) $66,000

B) $90,000

C) $95,000

D) $103,000

E) None of the above

Correct Answer:

Verified

Q2: For the year ended June 30,2017,the Rosaceae

Q2: Corporations are not allowed to amortize the

Q5: Which of the following companies is taxed

Q5: A corporation may carry forward capital losses

Q6: If a corporation is unable to deduct

Q6: Is it correct to state that the

Q9: Which of the following is true with

Q11: Corporations pay a flat 30 percent federal

Q12: Calculate the corporate tax liability in each

Q15: Corporations are granted favorable tax treatment for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents