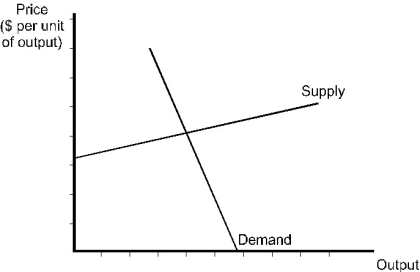

A specific tax will be imposed on a good. The supply and demand curves for the good are shown in the diagram below. Given this information, the burden of the tax:

A) is shared about evenly between consumers and producers.

B) falls mostly on consumers.

C) falls mostly on producers.

D) cannot be determined without more information on the price elasticities of supply and demand.

Correct Answer:

Verified

Q143: In general, the deadweight loss associated with

Q144: The formula Es/(Es - Ed) is used

Q147: The benefit of a subsidy accrues mostly

Q150: The market for all-leather men's shoes is

Q151: Consider the following statements when answering this

Q152: A government can impose an import quota

Q152: The market demand and supply functions for

Q158: Where Es is the elasticity of supply

Q168: Consider a good whose own price elasticity

Q174: The price elasticity of demand is -1.5.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents