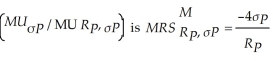

Mel and Christy are co-workers with different risk attitudes. Both have investments in the stock market and hold U.S. Treasury securities (which provide the risk free rate of return). Mel's marginal rate of substitution of return for risk  where

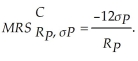

where  is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's

is the individual's portfolio rate of return and σP is the individual's portfolio risk. Christy's  Each co-worker's budget constraint is

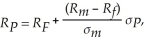

Each co-worker's budget constraint is  where

where  is the risk-free rate of return,

is the risk-free rate of return,  is the stock market rate of return, and

is the stock market rate of return, and  is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of

is the stock market risk. Solve for each co-worker's optimal portfolio rate of return as a function of  ,

,  and

and  .

.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q140: Scenario 5.10:

Hillary can invest her family savings

Q141: Suppose an investor equally allocates their wealth

Q142: Joan Summers has $100,000 to invest and

Q143: Is it possible for an investor to

Q144: Donna is considering the option of becoming

Q145: The risk-return indifference curves for a risk-neutral

Q146: Consider the following statements when answering this

Q147: Consider the following statements when answering this

Q148: Use the following statements to answer this

Q149: Jack is near retirement and worried that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents