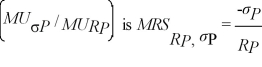

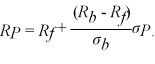

Donna is considering the option of becoming a co-owner in a business.Her investment choices are to hold a risk free asset that has a return of Rj and co-ownership of the business,which has a rate of return of Rb and a level of risk of σb.Donna's marginal rate of substitution of return for risk  where RP is Donna's portfolio rate of return and σP is her optimal portfolio risk.Donna's budget constraint is given by

where RP is Donna's portfolio rate of return and σP is her optimal portfolio risk.Donna's budget constraint is given by

Solve for Donna's optimal portfolio rate of return and risk as a function of Rj, Rb,and σb.Suppose the table below lists the relevant rates of returns and risks.Use this table to determine Donna's optimal rate or return and risk.

Investment Rate of Return Risk

Risk Free 0.06 0

Business 0.25 0.39

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: John Smith is considering the purchase of

Q87: The relationship between income and total utility

Q116: United Plastics Company produces large plastic cups

Q135: Sam's utility of wealth function is U(w)=

Q136: Mary is a fervent Iowa State University

Q137: Describe Larry,Judy and Carol's risk preferences.Their utility

Q140: Marsha owns a boat that is harbored

Q141: Mel and Christy are co-workers with different

Q142: Joan Summers has $100,000 to invest and

Q142: Reginald enjoys hunting whitetail deer.He has a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents