Jabba Ltd acquired a 70 per cent interest in Han Ltd on 30 June 2012 for $2,000,000. On the same date, Han Ltd acquired a 60 per cent interest in Leia Ltd for a cash consideration of $1,600,000. The purchase price represents the fair value of consideration transferred for both investments.

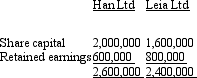

The share capital and retained earnings at the date of acquisition are as follows:

What is the non-controlling interest in Han Ltd and Leai Ltd, respectively on the date of acquisition using the full goodwill method (round to the nearest dollar) ?

A) $780,000; $960,000;

B) $857,143; 1,066,667;

C) $1,820,000; $1,440,000

D) $2,000,000; $1,600,000;

E) $2,857,143; $2,666,667.

Correct Answer:

Verified

Q8: A Ltd owns 85 per cent of

Q9: When a parent acquires its interest in

Q10: The non-controlling interest in post-acquisition movement in

Q21: Rose Ltd acquired a 75 per cent

Q22: The following diagram represents the ownership of

Q24: Pasta Ltd acquired an 80 per cent

Q25: The following diagram represents the ownership of

Q26: The following acquisition analysis relates to a

Q27: The following diagram represents the ownership of

Q28: The following is an extract from the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents