Monster Co Ltd owns 100 per cent of the issued shares of Mini Co Ltd. Mini Co Ltd declared a dividend of $100,000 for the period ended 30 June 2004. Monster Co Ltd accrues dividends when they are declared by its subsidiaries. What elimination entry would be required to prepare the consolidated financial statements for the group for the period ended 30 June 2005?

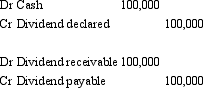

A)

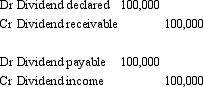

B)

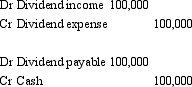

C)

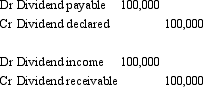

D)

E) None of the given answers.

Correct Answer:

Verified

Q24: What is the amount of unrealised profit

Q29: French Ltd owns 100 per cent of

Q32: Zeus Ltd owns 100 per cent of

Q33: Belgium Ltd owns all the issued capital

Q33: Large Company owns 80 per cent of

Q35: Which of the following statements describes the

Q36: What is the amount of unrealised profit

Q36: A non-current asset was sold by Subsidiary

Q37: Hammer Ltd acquired all the issued capital

Q38: Zeus Ltd owns 100 per cent of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents