French Ltd owns 100 per cent of the issued capital of Pastry Ltd. During the period ended 30 June 2006 Pastry Ltd sold inventory that cost $190,000 for $300,000 to French Ltd. Sixty per cent of this inventory remains on hand in French Ltd at the end of that year. Both companies use a perpetual inventory system. The taxation rate is 30 per cent.

What consolidation journal entries are required in relation to the inter-company transaction for the period ending 30 June 2007?

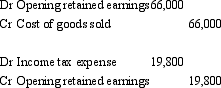

A)

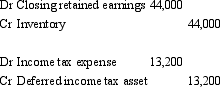

B)

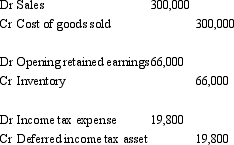

C)

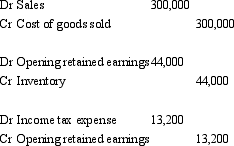

D)

E) None of the given answers.

Correct Answer:

Verified

Q24: What is the amount of unrealised profit

Q26: The journal entries to eliminate unrealised profit

Q27: Stormy Ltd has purchased all the issued

Q28: French Ltd purchased 100 per cent of

Q29: The treatment of dividends,paid by a subsidiary,that

Q30: Companies A,B and C are all part

Q32: Zeus Ltd owns 100 per cent of

Q33: Belgium Ltd owns all the issued capital

Q34: Monster Co Ltd owns 100 per cent

Q36: What is the amount of unrealised profit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents