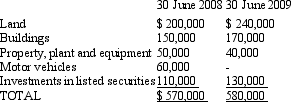

Do-it-Yourself Defined Contribution Plan owns the following assets with the following values:

The fund sold its motor vehicles for $70,000.

What amount of revenue for changes in net market value of assets should Do-it-Yourself Defined Contribution Plan recognise for the year ended 30 June 2009?

A) $10,000

B) $20,000

C) $50,000

D) $80,000

E) None of the given answers.

Correct Answer:

Verified

Q45: The accounting treatment for the sale of

Q48: The assets of a superannuation fund include:

A)

Q51: Which of the following statement(s)is/are correct?

A) AAS

Q52: AAS 25 requires a defined benefit plan

Q52: The following information relates to the Montigo

Q54: Use of professional judgement to establish the

Q55: The following information relates to the Old

Q58: A defined benefit superannuation plan is required

Q61: AAS 25 requires a defined contribution plan

Q62: Which of the following statements is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents