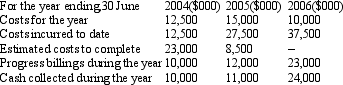

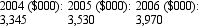

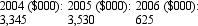

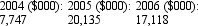

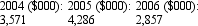

Hillier Construction Ltd commenced the construction of a building on 1 July 2003. It has a fixed-price contract for total revenues of $45 million. The expected completion date is 30 June 2006. The expected total cost to Hillier Construction at the beginning of the project is $35 million. The following information relates only to the construction of this building:

Hillier Construction uses the percentage of completion method based on cost to account for its construction contracts. What is the gross profit to be recognised in each of the 3 years (rounded to the nearest $000) ?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q41: Biological assets are:

A) recognised as income when

Q42: When the cost basis is used to

Q45: In considering whether to recognise revenue when

Q47: Hillier Construction Ltd commenced the construction of

Q49: Undersea Construction Ltd commenced the construction of

Q50: In relation to the expense associated with

Q50: The following journal entries were recorded by

Q52: Which of the following statements is not

Q53: Which of the following statements is not

Q57: Russell Ltd commenced the construction of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents