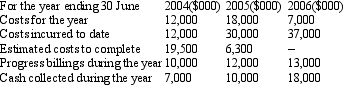

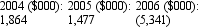

Russell Ltd commenced the construction of a bridge on 1July 2003. It has a fixed-price contract for total revenues of $35million. The expected completion date is 30 June 2006. The expected total cost to Russell Ltd at the beginning of the project is $29 million. The following information relates only to the construction of the bridge:

Russell Ltd uses the percentage of completion method based on cost to account for its construction contracts. What is the gross profit to be recognised in each of the 3 years (rounded to the nearest $000) ?

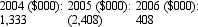

A)

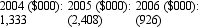

B)

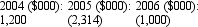

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q41: Biological assets are:

A) recognised as income when

Q42: When the cost basis is used to

Q45: In considering whether to recognise revenue when

Q52: Which of the following statements is not

Q52: Hillier Construction Ltd commenced the construction of

Q56: Using the cost method to calculate the

Q59: The following journal entries were recorded by

Q60: The percentage of completion can be measured

Q61: Which of the following statements is incorrect

Q63: Werribee Direct Ltd is a mail order

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents