Danish Ltd has an average weekly payroll of $200,000. The employees are entitled to 2 weeks', non-vesting sick leave per annum. Past experience suggests that 56 per cent of employees will take the full 2 weeks' sick leave and 22 per cent will take 1 week's leave each year. The rest of the employees take no sick leave. In the current week an employee with a weekly salary of $600 has been off sick for the first time this year. The employee took 2 days off out of her normal 5-day working week. Assuming that a weekly entry has been made to record the accumulated liability for sick leave and that PAYG tax is deducted at 30 per cent, what would the entry be to record the employee's weekly salary (round amounts to the nearest dollar) ?

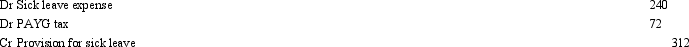

A)

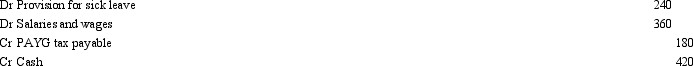

B)

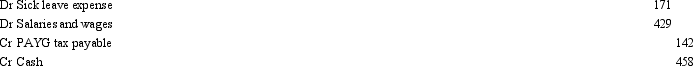

C)

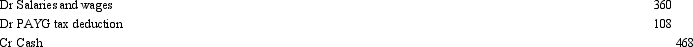

D)

E) None of the given answers.

Correct Answer:

Verified

Q5: In a defined contribution plan,the employer effectively

Q11: Any employee benefits that have been earned

Q16: When determining accounting entries to be made

Q22: Major Ltd has a weekly payroll of

Q25: Kerry Gill works for Kentucky Enterprises for

Q26: What discount rate does AASB 119 require

Q31: Short-term employee benefits are defined in AASB

Q33: According to the former Australian guidance section

Q34: 'On-costs' can be described as:

A) The additional

Q38: Because of the uncertainties involved in making

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents