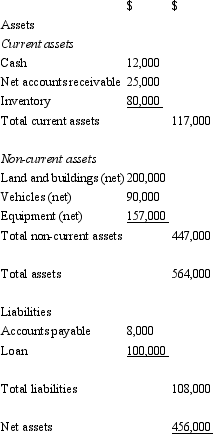

Big Ltd has purchased 100 per cent of Little Ltd for a cash payment of $800,000. The additional costs to Big Ltd to complete the purchase were $3,000. An extract from the balance sheet for Little Ltd at the date of acquisition shows:

Additional information:

The assets and liabilities of Little Ltd are stated at fair value except that:

Land and buildings have a fair value of $300,000

Accounts receivable have a fair value of $20,000

Little owns a licence that has not been recorded in the accounts. Its fair value is $150,000.

What is the amount of purchased goodwill, if any, that has been acquired by Big Ltd?

A) $242,000

B) $344,000

C) $252,000

D) $102,000

E) None of the given answers.

Correct Answer:

Verified

Q43: Prior to the introduction of impairment testing

Q49: Shelley Beach Ltd has one cash generating

Q49: Which of the following expenses are likely

Q51: AASB 138 contains some elements that seem

Q52: Which of the following intangible assets should

Q54: Broadbeach Ltd is a manufacturing company with

Q55: The approach to accounting for intangibles raises

Q56: Broadbeach Ltd is a manufacturing company with

Q56: In accordance with AASB 136 "Impairment of

Q60: Which of the following combination best demonstrates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents