Shelley Beach Ltd has one cash generating unit (CGU) and it has been determined that the CGU has incurred an impairment loss of $80,000 for the year ended 30 June 2012.

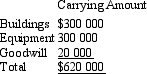

The carrying amounts of the assets as at 30 June 2012 are as follows:

In accordance with AASB 136 "Impairment of Assets", what should be the carrying amounts for buildings, equipment and goodwill as at 30 June 2012, respectively?

A) $240 000; $300 000; $0;

B) $260 000; $260 000; $20 000;

C) $270 000; $270 000; $0;

D) $300 000; $300 000; $20 000;

E) None of the given answers.

Correct Answer:

Verified

Q43: Prior to the introduction of impairment testing

Q44: Palm Beach Ltd has a cash generating

Q48: Which of the following statements in regard

Q50: Prior to the introduction of AASB 138

Q51: AASB 138 contains some elements that seem

Q52: Which of the following intangible assets should

Q53: Big Ltd has purchased 100 per cent

Q54: Broadbeach Ltd is a manufacturing company with

Q58: As part of adopting IFRS,goodwill acquired in

Q60: Which of the following combination best demonstrates

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents