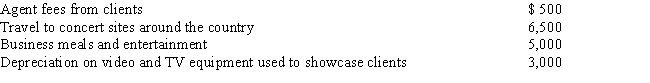

Terry is a practicing attorney who decides to become an agent for musical groups on the side. Terry engages in the activity and has the following revenue and expenses:

a.What are four of the factors the IRS will consider when evaluating whether her activity is a hobby?

b.If the activity is deemed to be a regular business, what is the amount of Terry's net income or loss from the activity?

c.If the activity is deemed to be a hobby, what is the amount (if any) of Terry's expenses from the activity that may be deducted, before applying the 2 percent of AGI floor for miscellaneous itemized deductions?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q95: Kendra is a self-employed taxpayer working exclusively

Q103: Net operating losses may be carried forward

Q104: Anna is a self-employed newspaper columnist who

Q106: The net operating loss (NOL)provisions of the

Q107: In determining whether an activity should be

Q114: Keri is a single taxpayer and has

Q115: Richard operates a hair styling boutique out

Q115: Karen was ill for most of the

Q119: Dennis is a self-employed hair stylist who

Q121: Katie operates a ceramics studio from her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents