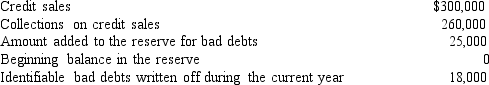

Fabricio, Inc. is an accrual-basis corporation. It ages its receivables to calculate the addition to its reserve for bad debts. The following were reported during the current year:  The amount deductible for bad debt expense on Fabricio's tax return for the current year is:

The amount deductible for bad debt expense on Fabricio's tax return for the current year is:

A) $18,000

B) $25,000

C) $40,000

D) $43,000

Correct Answer:

Verified

Q41: Cailey incurs $3,600 for business meals while

Q42: Nick owns a home in Daytona Beach,

Q44: Isabel owns a vacation home in Hawaii.During

Q46: Gina flew from Miami to San Diego

Q47: Gigi's legal expenses for the year included

Q54: Which of the following business expenses is

Q59: All of the following expenses are deductible

Q88: Nicholas wanted to take an important customer

Q92: Waldo bought two tickets for a Packers

Q95: Jordan is a self-employed tax attorney who

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents