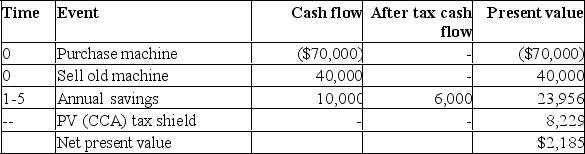

The Taylor Corporation is using a machine that originally cost $66,000. The machine has a book value of $66,000 and a current market value of $40,000. The asset is in the Class 8 CCA pool. It will have no salvage value after 5 years and the company tax rate is 40%.

Jacqueline Elliott, the Chief Financial Officer of Taylor, is considering replacing this machine with a newer model costing $70,000. The new machine will cut operating costs by $10,000 each year for the next five years. Taylor's cost of capital is 8%.

Should the firm replace the asset? (Use NPV methodology to solve this problem.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q117: The modified internal rate of return (MIRR)assumes

Q121: A&B Enterprises is trying to select the

Q121: List the 5 methods for evaluating cash

Q122: The Net Present Value (NPI)method of evaluating

Q123: The average accounting return (AAR)is fairly easy

Q124: Creative Impulse has done development work on

Q124: Explain the payback period method for evaluating

Q125: Explain the Profitability Index (PI)method of evaluating

Q126: List the 5 steps in the decision

Q130: The law firm of Bushmaster, Cobra and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents