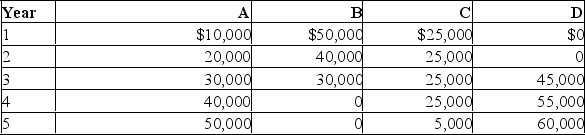

A&B Enterprises is trying to select the best investment from among four alternatives. Each alternative involves an initial outlay of $100,000. Their cash flows follow:

Evaluate and rank each alternative based on a) payback period, b) net present value (use a 10% discount rate), and c) internal rate of return.

Evaluate and rank each alternative based on a) payback period, b) net present value (use a 10% discount rate), and c) internal rate of return.

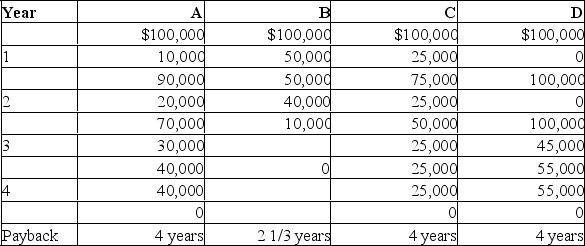

A) Payback period

Based on payback period, our choice is B.

Based on payback period, our choice is B.

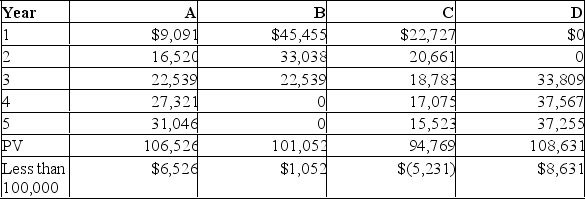

B) Net present value (NPV)

PV of Inflows @ 10%

Based on net present value analysis, our first choice is D, followed by A, then

Based on net present value analysis, our first choice is D, followed by A, then

B. We would not select alternative C.

C) Internal rate of return (IRR)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: For high-IRR investments, it is perfectly acceptable

Q110: A strength of the average accounting return

Q113: The CCA tax shield formula produces the

Q116: Under CCA amortization you must first subtract

Q117: The modified internal rate of return (MIRR)assumes

Q122: The Net Present Value (NPI)method of evaluating

Q123: The average accounting return (AAR)is fairly easy

Q124: Explain the payback period method for evaluating

Q124: Creative Impulse has done development work on

Q125: The Taylor Corporation is using a machine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents