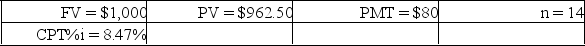

The Accidental Petroleum Company is trying to determine its weighted average cost of capital for use in making a number of investment decisions. The firm's bonds were issued 6 years ago and have 14 years left until maturity. They carried an 8% coupon rate paid annually, and are currently selling for $962.50.

The firm's preferred stock carries a $4.60 dividend and is currently selling at $42.50 per share. Accidental's investment dealer has stated that issue costs for new preferred will be 50 cents per share.

The firm has significant retained earnings, but will also need to sell new common stock to finance the projects it is now considering. Accidental Petroleum common stock is expected to pay a $2.50 per share dividend next year, and is expected to maintain an 8% growth rate for the foreseeable future. The stock is currently priced at $50 per share, but new common stock will have flotation costs of 60 cents per share.

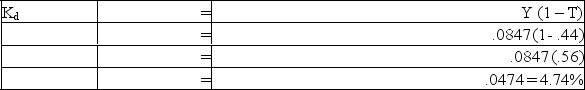

Calculate the costs of the various components of Accidental Petroleum's capital. The firm's tax rate is 44%.

Cost of Debt (before tax)

Cost of Debt (after tax)

Cost of Debt (after tax)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: Modigliani and Miller originally suggested that firm

Q124: What options do small businesses have for

Q125: A general increase in interest rates will

Q127: A stock with a Beta of .85

Q129: In the traditional approach to cost-of-capital analysis,firm's

Q130: Zinger Corporation manufactures industrial type sewing machines.Zinger

Q131: Given the information about Accidental Petroleum in

Q133: The addition of bankruptcy costs in Modigliani

Q138: In the Net Operating Income approach to

Q139: An increase in investors risk aversion will

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents