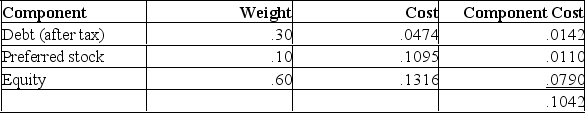

Given the information about Accidental Petroleum in the previous problem, calculate the company's weighted average cost of capital assuming that its new financing will consist of 30% debt, 60% equity, and 10% preferred stock.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: A stock that had a beta of

Q123: Modigliani and Miller originally suggested that firm

Q124: What options do small businesses have for

Q125: A general increase in interest rates will

Q127: A stock with a Beta of .85

Q129: In the traditional approach to cost-of-capital analysis,firm's

Q130: Zinger Corporation manufactures industrial type sewing machines.Zinger

Q131: The final conclusions of Modigliani and Miller

Q133: The Accidental Petroleum Company is trying to

Q133: The addition of bankruptcy costs in Modigliani

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents