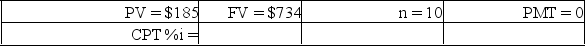

Samuel Johnson invested in gold Maple Leaf coins 10 years ago, paying $185 for each one-ounce gold coin. He could sell each coin for $734 today. What was his annual rate of return for this investment?

Correct Answer:

Verified

Q4: Higher interest rates (discount rates) reduce the

Q8: Cash flow decisions that ignore the time

Q23: Using semiannual compounding rather than annual compounding

Q82: Alternative 2 results in the lowest overall

Q90: You have an opportunity to buy a

Q91: In January, Harold Black bought 100 shares

Q93: The present value of a positive future

Q96: What is the difference between a nominal

Q97: You are considering the purchase of a

Q100: Gary Kiraly wants to buy a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents