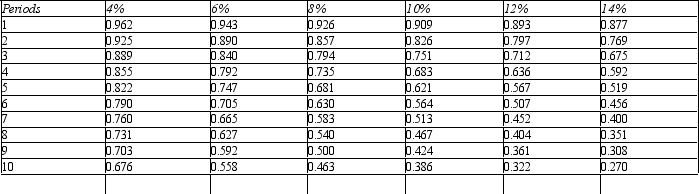

Figure 14-10.

Present value of $1

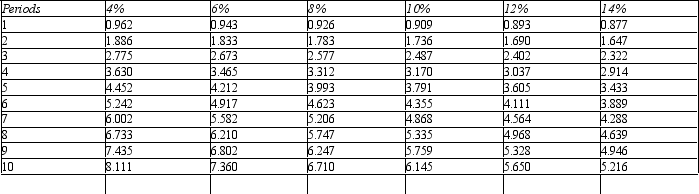

Present value of an Annuity of $1

Present value of an Annuity of $1

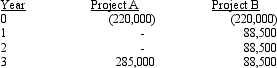

Refer to Figure 14-10.Durrel Company is considering two different modifications to its current manufacturing process.The after-tax cash flows associated with the two investments are as follows:

Refer to Figure 14-10.Durrel Company is considering two different modifications to its current manufacturing process.The after-tax cash flows associated with the two investments are as follows:

Durrel's cost of capital is 6 percent.

Durrel's cost of capital is 6 percent.

Required:

A.Compute the NPV for each investment and state which project should be chosen based on the NPV.

B.Compute the IRR for each investment and state which project should be chosen based on the IRR.

Correct Answer:

Verified

Q148: Figure 14-11.

Present value of an Annuity of

Q149: Figure 14-10.

Present value of $1

Q151: Fill in the lettered blanks in the

Q152: Billings Office Services is considering the purchase

Q154: Figure 14-10.

Present value of $1

Q155: Barker Production Company is considering the purchase

Q156: Figure 14-10.

Present value of $1

Q162: What are some reasons why firms use

Q164: Which model of capital investment decision making

Q168: What is a capital investment decision? Give

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents