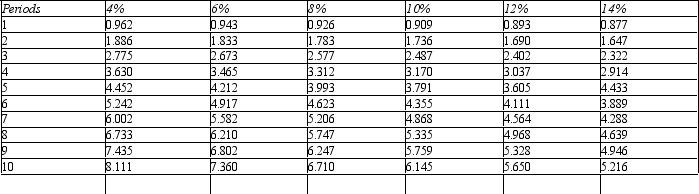

Figure 14-11.

Present value of an Annuity of $1 in Arrears

Refer to Figure 14-11.Aragon Company is considering an investment in equipment that will have an initial cost of $560,290 and yield annual net cash inflows of $90,000.Yearly depreciation will be $56,000.The equipment is expected to be useful for 10 years and then it will be scrapped.Aragon requires a minimum rate of return of 10 percent.

Refer to Figure 14-11.Aragon Company is considering an investment in equipment that will have an initial cost of $560,290 and yield annual net cash inflows of $90,000.Yearly depreciation will be $56,000.The equipment is expected to be useful for 10 years and then it will be scrapped.Aragon requires a minimum rate of return of 10 percent.

Correct Answer:

Verified

Q143: Figure 14-11.

Present value of an Annuity of

Q144: Figure 14-10.

Present value of $1

Q145: Figure 14-10.

Present value of $1

Q146: Dale Davis Company is evaluating a proposal

Q149: Figure 14-10.

Present value of $1

Q151: Fill in the lettered blanks in the

Q152: Billings Office Services is considering the purchase

Q153: Figure 14-10.

Present value of $1

Q162: What are some reasons why firms use

Q170: Name two nondiscounting capital investment models. What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents