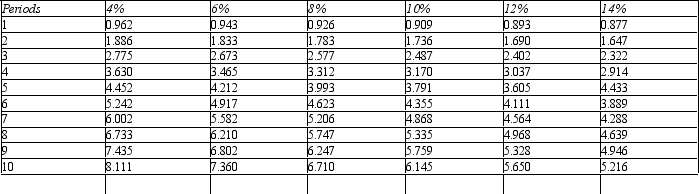

Figure 14-11.

Present value of an Annuity of $1 in Arrears

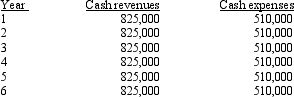

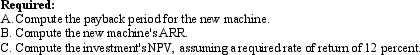

Refer to Figure 14-11.Lyster Company wants to buy a new machine that will be able to perform many of the steps in the manufacturing process that they currently have to do manually.The hope is that it will reduce the amount of time it takes to create one unit and reduce the number of defective units.The machine requires an investment of $750,000.The machine will last six years with no expected salvage value.The expected after-tax cash flows associated with the project are as follows:

Refer to Figure 14-11.Lyster Company wants to buy a new machine that will be able to perform many of the steps in the manufacturing process that they currently have to do manually.The hope is that it will reduce the amount of time it takes to create one unit and reduce the number of defective units.The machine requires an investment of $750,000.The machine will last six years with no expected salvage value.The expected after-tax cash flows associated with the project are as follows:

Correct Answer:

Verified

Q133: How do NPV and IRR differ?

A) NPV

Q136: The best person/group in a firm to

Q140: The capital investment decision making model that

Q141: Mistral Manufacturing is considering an investment in

Q142: Figure 14-11.

Present value of an Annuity of

Q144: Figure 14-10.

Present value of $1

Q145: Figure 14-10.

Present value of $1

Q146: Dale Davis Company is evaluating a proposal

Q148: Figure 14-11.

Present value of an Annuity of

Q170: Name two nondiscounting capital investment models. What

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents