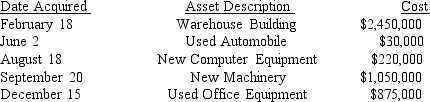

Table 1: Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2013:

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

-Refer to the information in Table 1.What is Sanjuro Corporation's cost recovery deduction for the automobile for 2016 assuming the necessary elections were made to maximize overall depreciation in 2013?

A) $0

B) $1,775

C) $1,875

D) $1,975

Correct Answer:

Verified

Q34: Gribble Corporation acquires the Dibble Corporation for

Q47: Purchased software is eligible for

A)MACRS depreciation only

B)straight-line

Q49: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q50: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q52: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q53: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q54: Table 1: Sanjuro Corporation (a calendar-year corporation)purchased

Q61: The lease inclusion amount:

A)Increases the annual lease

Q66: All of the following are characteristics of

Q78: Research and experimentation expenditures can be:

A)Expensed when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents