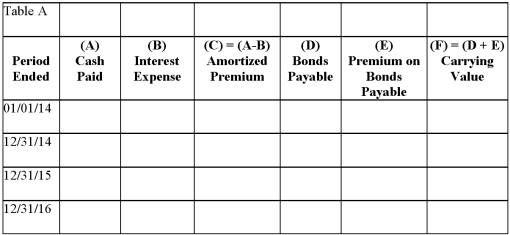

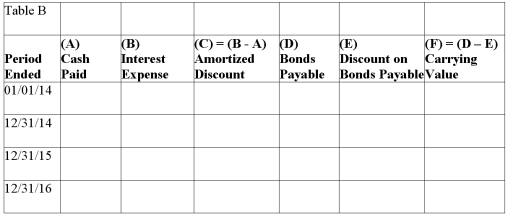

On January 1,2014,a company sells a 3-year bond with a face value of $50,000 and a stated interest rate of 7%.Because the market interest rate is 5%,the company receives $52,723 for the bond.The company uses the effective interest method of amortization.Fill in Table

A.Fill in Table B assuming the market interest rate is 9%,and the company received only $47,469 for the bond and the company uses the effective-interest method.

Correct Answer:

Verified

Q135: Use the information above to answer the

Q137: Use the information above to answer the

Q138: Use the information above to answer the

Q139: All of the following may be used

Q140: The following data came from the financial

Q141: Part I

FWP Co.issued $100,000,10-year bonds on January

Q142: Bonds with a stated interest rate of

Q143: On January 1,2014,a company sells a 3-year

Q144: Calculate the quick ratio and the times

Q194: A company issued 10-year,7% bonds with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents