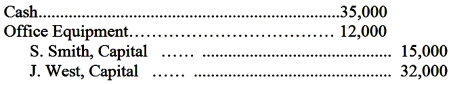

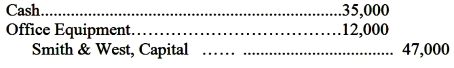

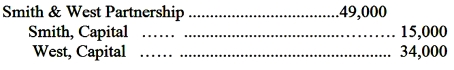

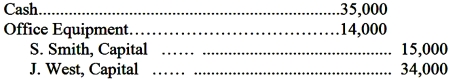

Smith contributed $15,000 cash while J.West contributed $20,000 cash and office equipment costing $14,000 currently valued at $12,000 to a new partnership.The journal entry to record the partnership investments of Smith and West is

A)

B)

C)

D)

Correct Answer:

Verified

Q48: The financial statement that shows the division

Q52: If a partnership's salary and interest allowances

Q53: The entry to record the investment of

Q54: The statement of partners' equities summarizes the

Q55: Federal income tax is levied on

A) a

Q57: Which of the following statements is correct?

A)The

Q57: Robert Ballard,a sole proprietor,entered into partnership with

Q58: When a partner submits personal living expenses

Q59: On November 1,Jackson and Kiln formed a

Q61: Partnership net income of $135,000 is to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents