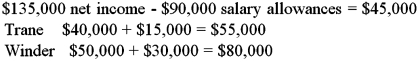

Partnership net income of $135,000 is to be divided between two partners,Ross Trane and Jane Winder,according to the following arrangement: There will be salary allowances of $40,000 for Trane and $50,000 for Winder,with the remainder divided one-third and two-thirds respectively per their partnership agreement.How much of the net income will be distributed to Trane and Winder,respectively?

A) $45,000 and $90,000

B) $30,000 and 15,000

C) $15,000 and $30,000

D) $55,000 and $80,000

Correct Answer:

Verified

Q48: The financial statement that shows the division

Q56: Smith contributed $15,000 cash while J.West contributed

Q57: Robert Ballard,a sole proprietor,entered into partnership with

Q58: When a partner submits personal living expenses

Q59: On November 1,Jackson and Kiln formed a

Q62: The general ledger of a partnership will

A)

Q63: Valerie Wone and Samantha Wall are partners

Q64: Sam Sung and Mitchell Vaughn are partners,and

Q65: Partnership net income of $66,000 is to

Q66: Sam McGuire and Marcos Valle are partners,and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents