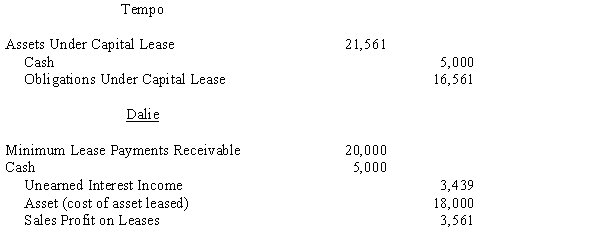

Tempo Industries is an 80%-owned subsidiary of Dalie Inc. On January 1, 20X8, Dalie leased an asset to Tempo and the following journal entries were made:

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year. The implicit interest rate used by both Dalie and Tempo is 8%.

The terms of the lease agreement require Tempo to make five payments of $5,000 each at the beginning of each year. The implicit interest rate used by both Dalie and Tempo is 8%.

Required:

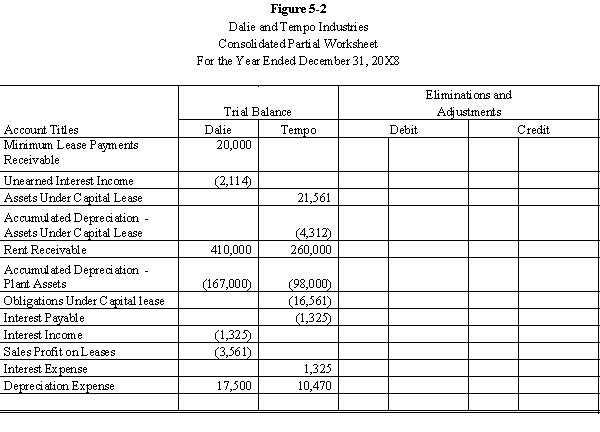

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-2 partial worksheet of December 31, 20X8. Key and explain all eliminations and adjustments.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: When one member of a consolidated group

Q11: In the year when one member of

Q13: On an income distribution schedule, any gain

Q27: Which of the following statements is true?

A)

Q28: Lion Company leased equipment to its wholly

Q33: Which of the following statements is true?

A)

Q34: Leasing subsidiaries are formed to achieve centralized

Q37: Smart Corporation is a 90%-owned subsidiary of

Q38: Lease terms can be considered to be

Q40: The effect of an operating lease on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents