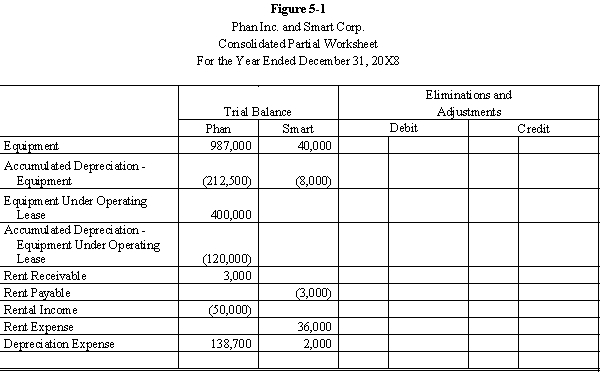

Smart Corporation is a 90%-owned subsidiary of Phan Inc. On January 2, 20X6, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease. The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-1 partial worksheet for December 31, 20X8. Key and explain all eliminations and adjustments.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: In the year when one member of

Q32: Tempo Industries is an 80%-owned subsidiary of

Q33: Which of the following statements is true?

A)

Q34: Leasing subsidiaries are formed to achieve centralized

Q38: Lease terms can be considered to be

Q38: Phil Company leased a machine to its

Q39: On January 1, 20X8, Pope Company acquired

Q40: Phil Company leased a machine to its

Q41: On January 1, 20X8, Parent Company purchased

Q42: On January 1, 20X1, Parent Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents