On January 1, 20X8, Parent Company purchased 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $20,000, $130,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent account for the Investment in Subsidiary using the simple equity method.

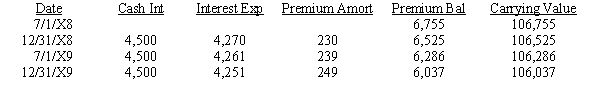

On July 1, 20X8, Subsidiary sold $100,000 par value of 9%, ten-year bonds for $106,755, which resulted in an effective interest rate of 8%. The bonds pay interest semi-annually on January 1 and July 1 of each year. Subsidiary uses the effective-interest method of amortizing the premium.

An amortization table for 20X8 and 20X9 is presented below:

On July 1, 20X9, Parent repurchased all of Par's bonds for $94,153, which resulted in an effective interest rate of 10%. The bonds are still held at year end.

On July 1, 20X9, Parent repurchased all of Par's bonds for $94,153, which resulted in an effective interest rate of 10%. The bonds are still held at year end.

Both companies have correctly recorded all entries relative to bonds and interest.

Required:

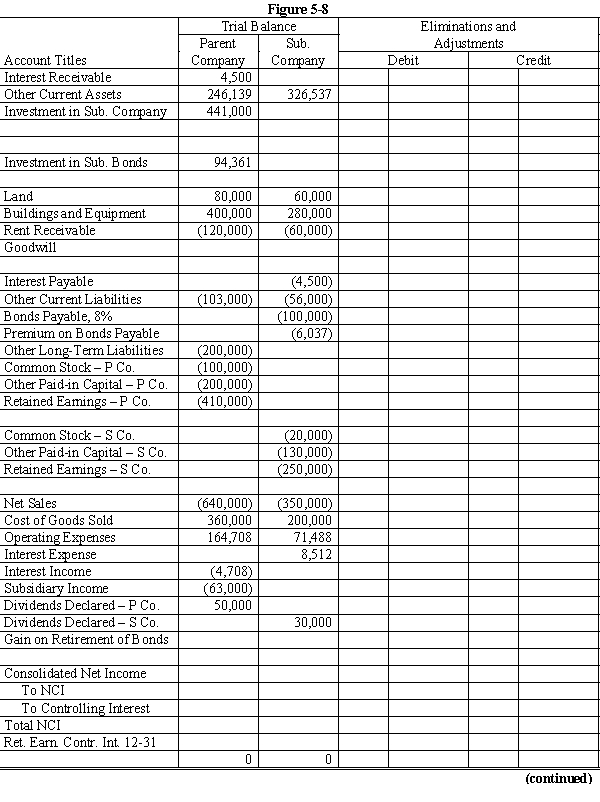

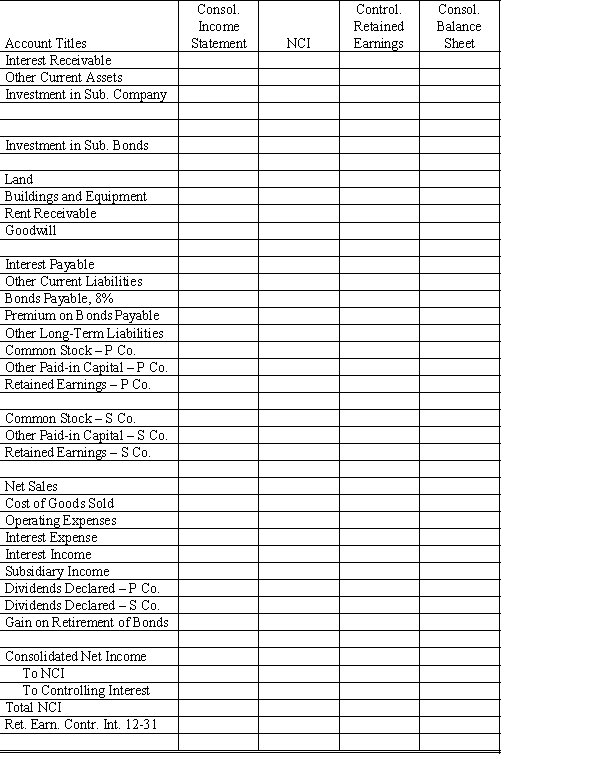

Complete the Figure 5-8 worksheet for consolidated financial statements for the year ended of December 31, 20X9. Round all computations to the nearest dollar.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Leasing subsidiaries are formed to achieve centralized

Q37: Smart Corporation is a 90%-owned subsidiary of

Q38: Phil Company leased a machine to its

Q39: On January 1, 20X8, Pope Company acquired

Q40: Phil Company leased a machine to its

Q42: On January 1, 20X1, Parent Company acquired

Q43: On January 1, 20X8, Pope Company acquired

Q44: On January 1, 20X1 Parent Company acquired

Q45: On January 1, 20X1, Porter Company purchased

Q46: On January 1, 20X8, Parent Company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents