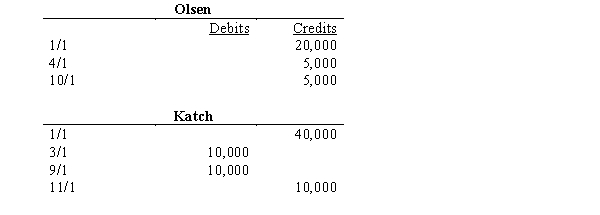

Olsen and Katch organized the OK Partnership on 1/1/01. The following entries were made into their capital accounts during 01:

The partnership agreement called for the following in the allocation of partnership profits and losses:

The partnership agreement called for the following in the allocation of partnership profits and losses:

Salaries of $48,000 and $36,000 would be allocated to Olsen and Katch, respectively

Interest of 8% on average capital balances will be allocated

Katch will receive a bonus of 10% on all partnership billings in excess of $300,000

Any remaining profits/losses will be allocated 60/40 to Olsen and Katch, respectively.

Required (account for each situation independently):

a.

Determine the distribution of partnership net income. Assume the following priority of allocation: interest, bonus, salaries, then remaining assuming partnership income of $85,000; partnership billings amounted to $400,000

b.

Determine the distribution of partnership net income of $165,000 on billings of $400,000. No specific priority is given to any of the allocation criteria.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: Which of the following is not an

Q7: Under the entity theory, a partnership is

A)viewed

Q19: Partner A first contributed $20,000 of capital

Q20: Partnership drawings are

A) always maintained in a

Q22: Barnes and Noble, both lawyers, have decided

Q23: Tupper and Tolin have decided to

Q25: The Amato, Bergin, Chelsey partnership profit

Q26: Carey and Drew formed a partnership on

Q27: Which of the following characteristics of a

Q29: Matt and Jeff organized their partnership on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents