In January, 20X3, Dudwil Corporation acquired a foreign subsidiary, Holman Company, by paying cash for all of the outstanding common stock of Holman. On the purchase date, Holman Company's accounts were stated fairly in local currency units (FC). Subsequent sales of Holman's common stock have been purchased by Dudwil to maintain its 100% ownership.

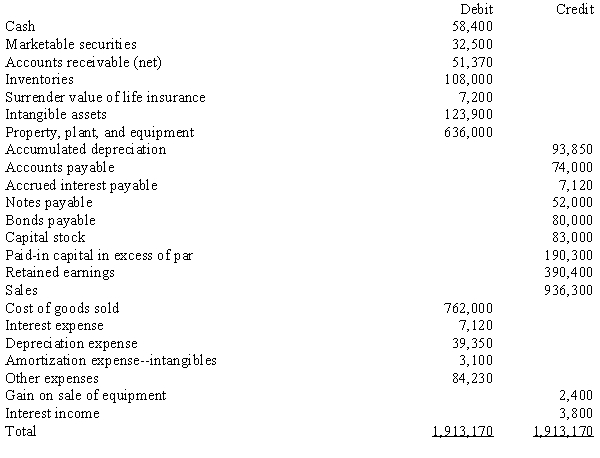

Holman's trial balance, in functional currency units (same as the local currency units), on December 31, 20X7, follows:

The following additional information is available:

The following additional information is available:

a.

Holman uses the LIFO inventory method to account for its inventory. Purchases took place uniformly throughout 20X7. There were no intercompany sales during 20X7.

b.

During 20X7, Holman declared and paid a dividend of 7,000 FCs at the end of each calendar quarter.

c.

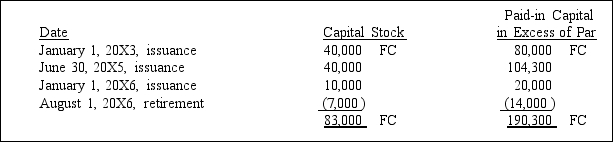

The balances in the contributed capital accounts result from the following transactions:

Paid-in Capital

Date

Capital Stock

in Excess of Par

January 1, 20X3, issuance

40,000

FC

80,000

FC

June 30, 20X5, issuance

40,000

104,300

January 1, 20X6, issuance

10,000

20,000

August 1, 20X6, retirement

(7,000)

(14,000)

83,000

FC

190,300

FC

The August 1, 20X6, retirement of stock involves stock originally issued on January 1, 20X3.

d.

The December 31, 20X6, retained earnings balance of 418,400 FC, translated into dollars, is $179,460.

e.

Selected translation rates are as follows:

Paid-in Capital

Date

Capital Stock

in Excess of Par

January 1, 20X3, issuance

40,000

FC

80,000

FC

June 30, 20X5, issuance

40,000

104,300

January 1, 20X6, issuance

10,000

20,000

August 1, 20X6, retirement

(7,000)

(14,000)

83,000

FC

190,300

FC

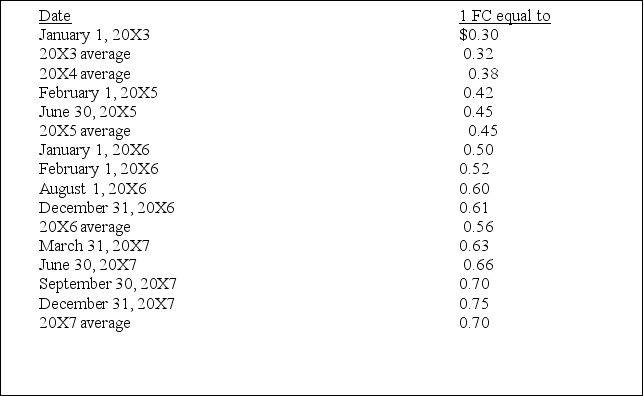

Date

1 FC equal to

January 1, 20X3

$0.30

20X3 average

0.32

20X4 average

0.38

February 1, 20X5

0.42

June 30, 20X5

0.45

20X5 average

0.45

January 1, 20X6

0.50

February 1, 20X6

0.52

August 1, 20X6

0.60

December 31, 20X6

0.61

20X6 average

0.56

March 31, 20X7

0.63

June 30, 20X7

0.66

September 30, 20X7

0.70

December 31, 20X7

0.75

20X7 average

0.70

Required:

Prepare a schedule to translate the December 31, 20X7, trial balance of Holman Company from local currency units to dollars. The schedule should show the trial balance in FCs, the exchange rates, and the trial balance. (Do not extend the trial balance to statement columns. Supporting schedules should be in good form.)

Correct Answer:

Verified

Q38: A foreign subsidiary of Dallas Jeans Corp.

Q41: A U.S. firm purchased 100% of

Q43: For each of the following account balances,

Q44: A U.S.-owned foreign subsidiary has the

Q45: Kerry Manufacturing Company is a German

Q46: On January 1, 20X1, Rapid Corporation purchased

Q47: In the functional or current method of

Q50: The adjustment resulting from the remeasurement of

Q60: Which of the following best describes the

Q65: Discuss the factors that may be considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents