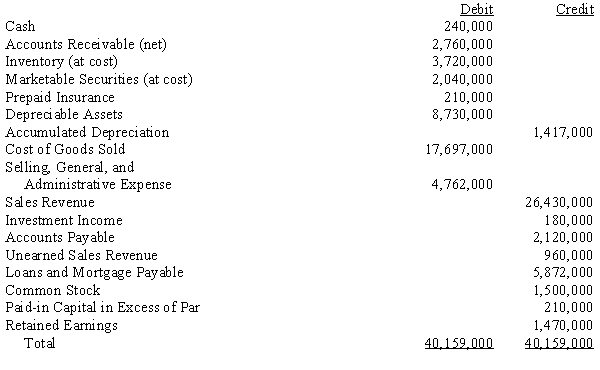

Kerry Manufacturing Company is a German subsidiary of a U.S. company. Kerry records its operations and prepares financial statements in euros. However, its functional currency is the British pound. Kerry was organized and acquired by the U.S. company on June 1, 20X4. The cumulative translation adjustment as of December 31, 20X6, was $79,860. The value of the subsidiary's retained earnings expressed in British pounds and U.S. dollars as of December 31, 20X7, was 365,000 pounds and $618,000, respectively. On March 1, 20X7, Kerry declared a dividend of 120,000 euros. The trial balance of Kerry in euros as of December 31, 20X7, is as follows:

The marketable securities were acquired on November 1, 20X6, and the prepaid insurance was acquired on December 1, 20X7. The cost of goods sold and the ending inventory are calculated by the weighted-average method. The underlying costs have been incurred uniformly throughout the year. On June 1, 20X4, 60% of the depreciable assets existed, and the balance was acquired on March 1, 20X6. The depreciable assets are amortized over a 10-year period by the straight-line method. Of the total depreciation expense, 80% is traceable to the cost of goods sold and the balance is in general expenses. On November 1, 20X6, Kerry received a customer prepayment valued at 3,000,000 euros. On February 1, 20X7, 2,040,000 euros of the prepayment was earned. The balance remains unearned as of December 31, 20X7.

The marketable securities were acquired on November 1, 20X6, and the prepaid insurance was acquired on December 1, 20X7. The cost of goods sold and the ending inventory are calculated by the weighted-average method. The underlying costs have been incurred uniformly throughout the year. On June 1, 20X4, 60% of the depreciable assets existed, and the balance was acquired on March 1, 20X6. The depreciable assets are amortized over a 10-year period by the straight-line method. Of the total depreciation expense, 80% is traceable to the cost of goods sold and the balance is in general expenses. On November 1, 20X6, Kerry received a customer prepayment valued at 3,000,000 euros. On February 1, 20X7, 2,040,000 euros of the prepayment was earned. The balance remains unearned as of December 31, 20X7.

Relevant exchange rates are as follows:

Required:

Prepare a remeasured and translated trial balance of the Kerry Manufacturing Company as of December 31, 20X7. Provide supporting schedules.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: A U.S. firm purchased 100% of

Q42: In January, 20X3, Dudwil Corporation acquired a

Q43: For each of the following account balances,

Q44: A U.S.-owned foreign subsidiary has the

Q46: On January 1, 20X1, Rapid Corporation purchased

Q47: In the functional or current method of

Q48: On January 1, 20X8, Cayane Inc. purchased

Q49: Complete the following table: Q50: The adjustment resulting from the remeasurement of Q50: Abercrombe Co., a U.S. firm, formed a

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents